Wendy’s is tightening its belt. The iconic fast-food chain plans to close hundreds of U.S. locations in the coming months as lower-income consumers pull back on spending. Rising food costs are squeezing wallets, and same-store sales are already down. While the company experiments with value meals and tech upgrades, it’s clear not all restaurants are thriving equally. Here’s what you need to know about Wendy’s strategic pullback and what it means for diners and investors alike.

Mid-Single Digit Closures Expected

Wendy’s interim CEO Ken Cook confirmed the chain will shutter roughly 5% of its U.S. locations. That’s about 300 restaurants, though exact locations haven’t been announced. These closures aim to focus on stronger-performing stores and improve overall profitability. The plan is set to begin in the fourth quarter of 2025.

Following a Pattern from 2024

This isn’t Wendy’s first wave of closures. In 2024, the chain closed 140 restaurants, citing outdated facilities. Many of these locations were underperforming and didn’t elevate the brand experience. The new round seems like a continuation of that strategy, but on a larger scale.

Consumer Squeeze Drives Decisions

Lower-income diners are feeling the pinch of rising food costs. Wendy’s notes that these consumers are cutting back, and this trend isn’t expected to ease anytime soon. Value meals are being pushed to entice these customers back into restaurants. Still, overall traffic remains a challenge.

Same-Store Sales Are Falling

In the first nine months of 2025, Wendy’s U.S. same-store sales fell 4% compared to last year. Revenue dropped 2% to $1.63 billion, while net income fell 6% to $138.6 million. The numbers highlight that even established brands aren’t immune to economic pressures.

Strategic Store Adjustments

Not every underperforming location will close. Some stores will receive upgrades, including new equipment and tech improvements. Others may be transferred to different operators. The goal is to maintain brand quality while maximizing franchisee financial performance.

CEO Transition Brings Fresh Perspective

Ken Cook took over as Wendy’s CEO in July, succeeding Kirk Tanner. Cook has been vocal about addressing struggling stores and streamlining operations. His leadership comes at a time when the chain faces economic and operational challenges.

Value Meal Push

Wendy’s $5 and $8 meal deals are central to its strategy to attract budget-conscious consumers. While similar deals are offered by competitors like McDonald’s, Wendy’s emphasizes the freshness of its ingredients to differentiate itself. This approach aims to maintain quality while appealing to cost-sensitive diners.

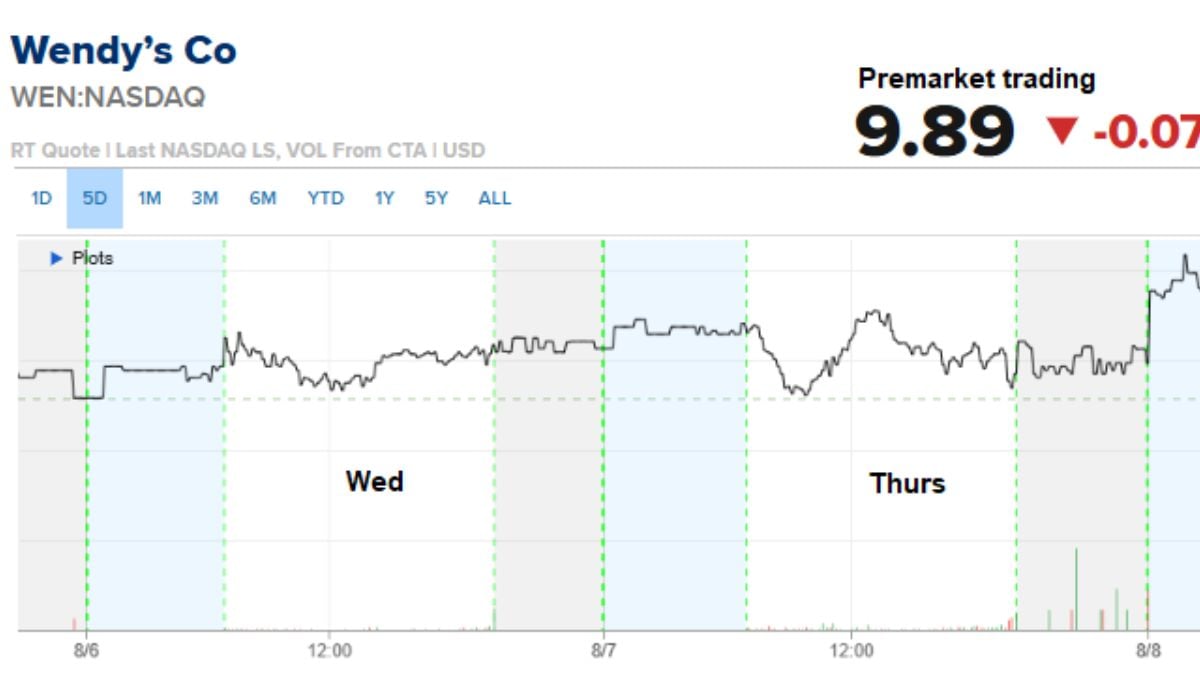

Financial Market Reaction

Despite ongoing challenges, Wendy’s shares saw a modest rise of 10 cents to $8.63 in early trading. However, the stock is still down 46% for the year. Investors remain wary of the chain’s ability to reverse declining traffic and revenue trends.

Operational Reality Check

The closures signal that not all Wendy’s restaurants contribute equally to the brand. Some are “dragging” performance, according to Cook. Addressing these weak points is seen as essential to maintaining long-term profitability and brand reputation.

A Turning Point for Wendy’s

Wendy’s is at a crossroads. Store closures, operational upgrades, and strategic marketing moves will define the next chapter for the brand. Lower-income consumers remain a critical demographic, and their spending habits will influence Wendy’s recovery.