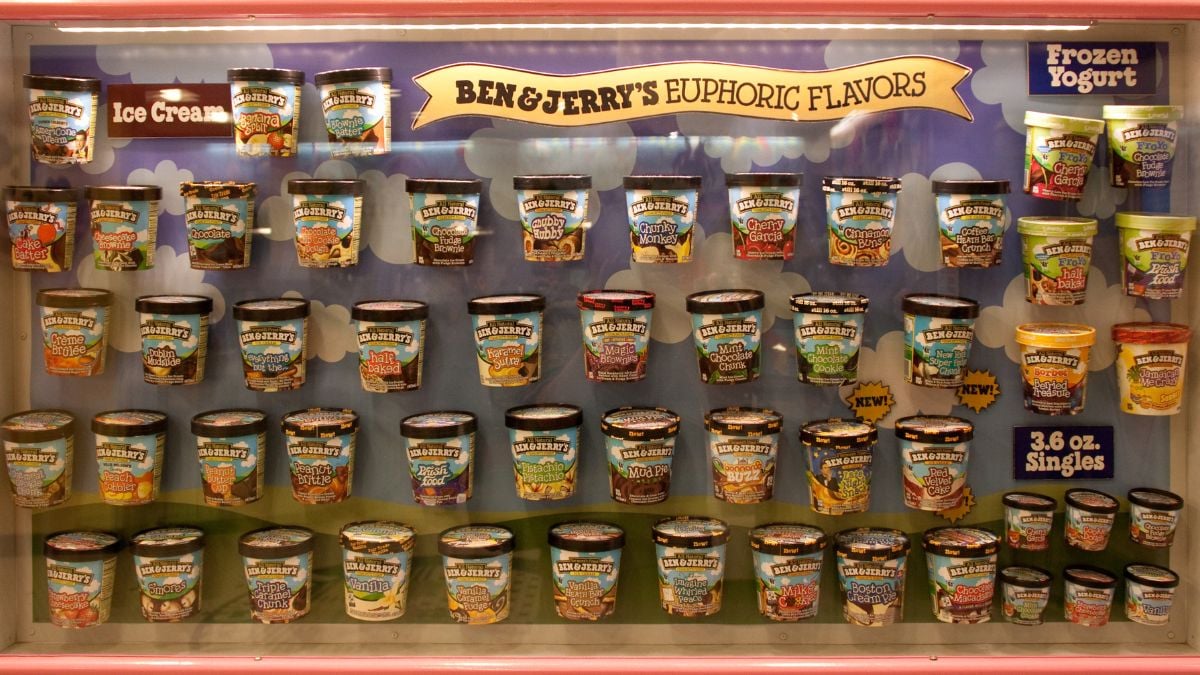

The beloved ice-cream label Ben & Jerry’s just hit a rough patch. With long-time co-founder Jerry Greenfield stepping down after decades, the brand’s identity around social activism is feeling the shake-up. Recent data from YouGov shows brand health slipping—but purchase intent holding steady. As discussions rage over what a purpose-driven business really means, Ben & Jerry’s finds itself in the middle of a brand-values showdown.

Brand Health Is Dropping

The overall Index score for Ben & Jerry’s fell to 24.8% by October 5, marking its lowest point this year. That score is a composite of measures like reputation, satisfaction, value and quality—all signals that consumer sentiment has cooled. The slide suggests that the brand’s stability might be under pressure, even if buying behaviour hasn’t yet cratered.

Buzz Score Took a Hit

The “buzz” metric, tracking whether people have heard positive or negative things about the brand, plunged from 11.6 on September 17 to 6.7 by October 5. That steep drop means more people are hearing chatter—likely negative—about Ben & Jerry’s. And when a brand’s talk-volume shifts like that, you know it’s in the spotlight for better or worse.

Word of Mouth Shows Attention Spike

While general sentiment slipped, the brand got more “air time”. Word-of-Mouth Exposure—meaning discussions with friends/family—went up, signalling that people are talking about Ben & Jerry’s. That kind of engagement can be a double-edged sword: attention is good, but it only counts if the story is favourable.

Purchase Intent Is Holding Steady

Despite the dips in brand perception, intent to buy dropped only one point. In plain terms: Most fans aren’t abandoning their pint-routines just yet. That suggests some strong brand loyalty or inertia—at least for now.

Core Customers Love Brand Activism

Among Ben & Jerry’s customers, 63% say companies should express opinions on social issues, compared to 57% of the general U.S. population. And 54% of the brand’s customers like brands that engage with social causes—versus 42% nationally. That shows the brand’s audience is more socially inclined than average, which has big implications.

Moral Messaging Gets Major Support

Crucially, 66% of the brand’s customers appreciate companies that take a moral stance, while only 56% of the broader U.S. population say the same. In other words: Ben & Jerry’s core tribe really buys into purpose-driven business. That’s a major asset if the brand leans into that identity.

But Skepticism Lingers

Even so, 46% of the brand’s consumers agree (definitely or tend to) that companies speaking out are simply exploiting issues for profit. That’s slightly below the national figure of 50%. So while the audience is more supportive, they’re not naive—they still question corporate sincerity.

Founder’s Departure Raises Flags

Jerry Greenfield’s recent exit after a disagreement with parent company Unilever over activism has stirred the pot. His departure signals some internal tension between the brand’s original purpose and corporate oversight—and that kind of narrative matters in brand perception.

What This Means for Brand Strategy

With brand health metrics sliding but purchase intent stable, the brand is at a crossroads. The strong support for activism among its core customers provides a structural advantage—but the departure of a founder and drop in buzz signal risks. The company will need to decide whether to lean harder into purpose or recalibrate its message.

Why Activist Branding Isn’t Always Safe

Brands that take strong social or political stances invite more attention—and more potential backlash. Data from other contexts show that while activism can boost consideration, it can also erode reputation if not handled carefully. For Ben & Jerry’s, the activist badge is part of the identity—but under corporate ownership that identity may be under strain.

What Consumers Are Watching

Individuals increasingly want brands to have values—but they also want authenticity. When there’s a hint of “just for show,” trust erodes. The fact that nearly half of Ben & Jerry’s customers see brand activism as potentially exploitative is a red-flag the company must not ignore.

Key Takeaway

Here’s the wrap: Ben & Jerry’s still has its supporters, especially among those who care about purpose. But the metrics show cracks in broad brand health, and the narrative around leadership and activism is under scrutiny. How the company navigates its values, ownership structure and brand voice in the next months will shape whether it can hold its ground—or slide further.

What’s Your Scoop?

So, have you reassessed how you think about brand activism? Is it a plus when a brand takes a stand—or a risk? If you’re a fan of Ben & Jerry’s (or just an observer of branding trends), let me know: Which move by the brand surprised you most, and what would you like them to do next? Drop a comment and tell us—your view matters!