Once entrenched in suburban strips and highway exits, these restaurant chains are now pulling back fast. Between massive debt loads, shifting consumer habits, and post-pandemic aftershocks, shelter for longstanding brands is shrinking. In 2024 and 2025, some of the most familiar names in casual dining have shuttered hundreds of locations. This slide show walks you through who’s disappearing, why it’s happening, and what’s coming next.

TGI Fridays: The Fall of the Bar & Grill Icon

TGI Fridays, that classic casual-dining hangout, has been in full retreat. In January 2024, it closed 36 underperforming stores across a dozen states. Then bankruptcy hit in November, and by early 2025 another ~30 closures followed. The brand is now operating under a fully franchised model, with only about 84 U.S. locations still open during the restructuring.

Red Lobster: How the Seafood Giant Sank

Red Lobster’s signature cheddar-bay biscuits couldn’t save it from a sea of debt. It filed Chapter 11 in May 2024, citing more than $1 billion in liabilities and just $30 million in cash. After its acquisition and restructuring, the number of open locations shrank from 650+ to roughly 513–530 nationwide. Analysts called it “the most spectacular restaurant collapse of 2024.”

Denny’s: The 24/7 Diner in Decline

Once a beacon of round-the-clock breakfasts, Denny’s announced plans in late 2024 to close 150 restaurants by the end of 2025. But closures outpaced projections—88 spots shuttered in 2024 alone. The brand plans to open 20–40 new stores to soften the blow, but overall it’s headed toward a leaner footprint.

Outback Steakhouse: Cutting Underperformers Hard

Bloomin’ Brands, parent company of Outback, announced 41 location closures across multiple brands in 2024—many being Outbacks. States like Illinois, Iowa, Florida, and New Hampshire lost outlets. In fact, New Hampshire and Hawaii lost all their Outback restaurants entirely. Rather than a full exit, this looks like aggressive trimming.

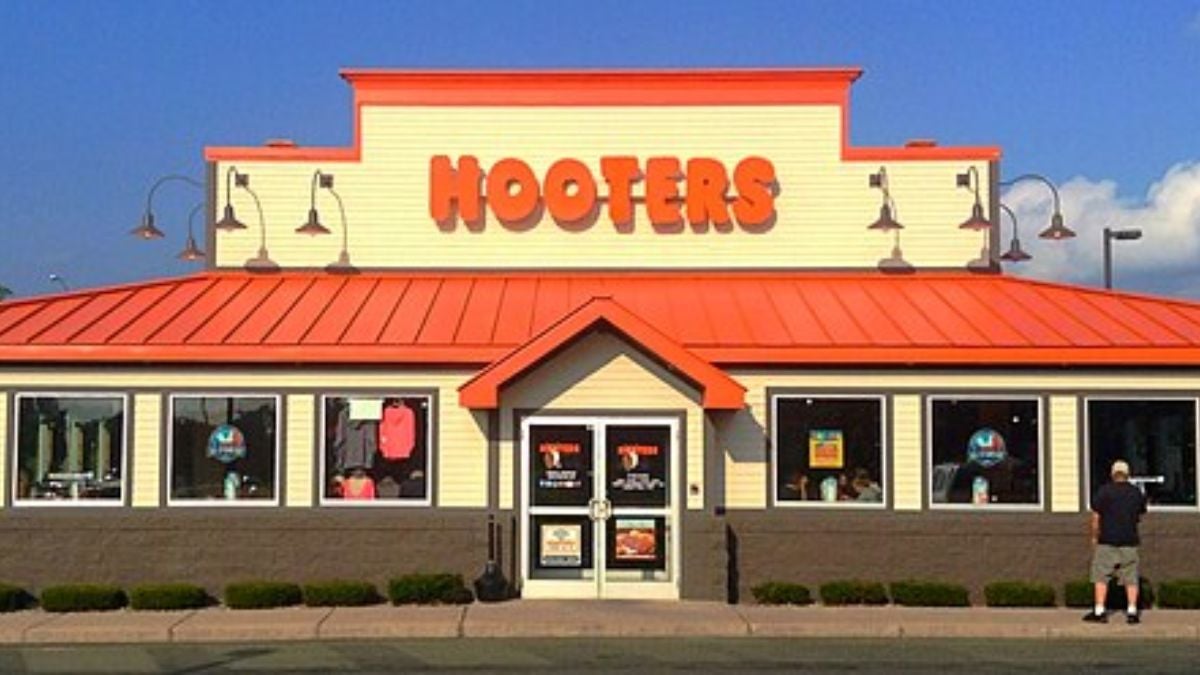

Hooters: Wings, Debt, and Restructuring

Hooters quietly closed ~40 restaurants in mid-2024, with major hits in Texas (15 closures) and Florida (4). In early 2025, another 30–40 locations shut down. By March 2025, the chain filed for bankruptcy, burdened by some $376 million in debts. Its signature model is now in survival mode.

Burger King: Even Whoppers Aren’t Safe

Burger King has been gradually slimming its U.S. presence. By 2024, some 400 restaurants had already closed, dropping the total below 7,000 nationwide. In April 2025, a major franchisee with 57 locations filed for Chapter 11, hinting at more closures ahead. The chain isn’t closing shop—but it’s retreating.

On the Border: Tex-Mex Brand Forced into Bankruptcy

On the Border filed for Chapter 11 in March 2025, citing labor shortages, sagging customer demand, and over $25 million in debt. The chain had already shuttered 40 weak spots prior. Sixty corporate-owned restaurants remain open during restructuring—but for many, the brand’s future is far from certain.

Noodles & Company: Pasta Chain in Retrenchment

Once a fast-casual darling, Noodles & Company is now shrinking to survive. It plans to close 49 locations by late 2026 in response to a 2.5% drop in foot traffic and eroding guest value perception. No bankruptcy yet—but this is a major pullback from its prior expansion mindset.

Applebee’s: Neighborhood Grill Under Pressure

Applebee’s is shrinking too, closing 33 locations in 2023 and another 25–35 in 2024. In Kansas City, eight locations went dark when a franchisee filed for bankruptcy, leaving only two in that area. Like many chains, it’s grappling with uneven performance and cost pressures.

IHOP: Quiet Contraction in the Breakfast Game

IHOP’s decline is more subtle, but real. The chain shut 20 to 30 locations in 2024 amid a franchisee bankruptcy. While these closures don’t immediately threaten national operations, they add to the pattern: even breakfast icons can’t rest easy in today’s market.

Red Robin: Lease Expirations Fuel Exits

Red Robin is taking a slow, lease-driven shrink. In 2025, it plans to close around 15 restaurants, with 70 potential closures over five years. It already shut one location in late 2024 when a lease expired. The closures aim to improve profitability and deal with debt, rather than mass exit.

The End of Dining Certainty

These closures show a harsh truth: no one is immune—even beloved chains. Rising costs, changing dining habits, overexpansion, and debt are colliding to force retrenchment. Some brands may reinvent themselves; others might vanish for good. Which closure hit you hardest? Was your favorite on this list? Drop a comment below if we missed one or if one of these shutterings left a real void in your town.